Managing your listings

Existing listings |

New listings |

|

|

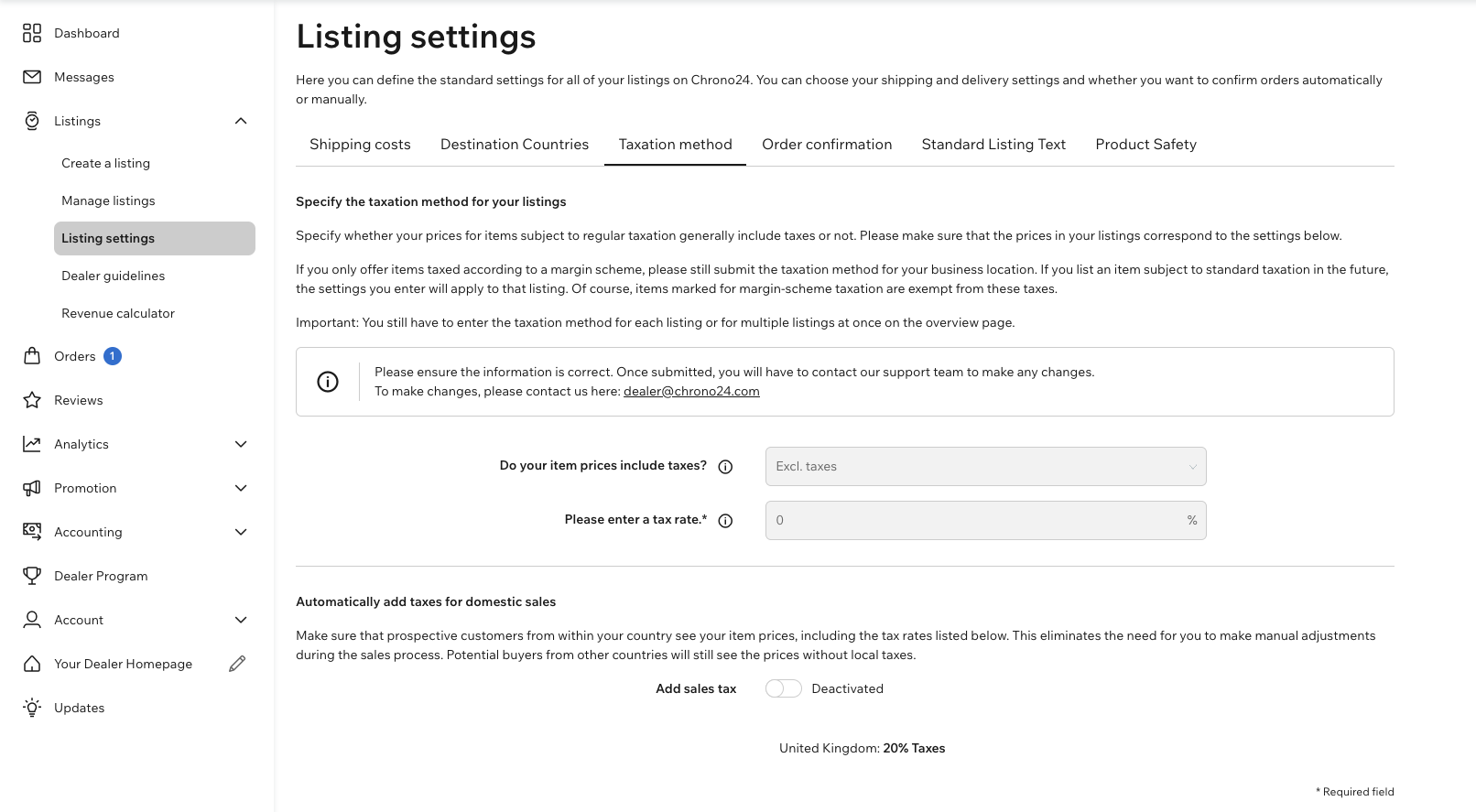

Check your default taxation method

Specify whether you generally list item prices with or without taxes. From now on, this information will affect the items subject to standard taxation. You can find this setting in the “Taxation method” section of your Market Portal. Please ensure that the item prices in your listings are aligned with your settings.

If you need to make changes, please contact us at dealer@chrono24.com.

If you list your watches by default "without taxes"

If you use the “Automatically add taxes for domestic sales” option for domestic sales:

- For items subject to standard taxation, your local standard tax rate will be added to the item price automatically.

- For items subject to a margin tax scheme, your local standard tax rate will not be added to item price.

Good to know:

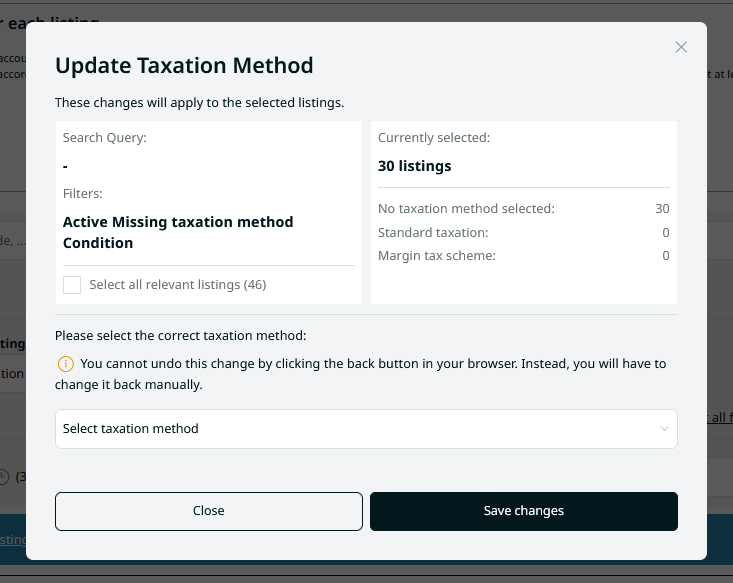

You can also set the taxation method for several items at once. Select the desired items under “Edit listings” and set the taxation method using the VAT icon.

More posts

June 11, 2025

New Chrono24 Brand Identity

With a comprehensive rebranding, the global marketing campaign "Time Is Our Thing," and a new corporate website, we are setting the course for the future. Our goal is clear: to establish Chrono24 as the world's first choice for buying and selling luxury watches.

April 29, 2025

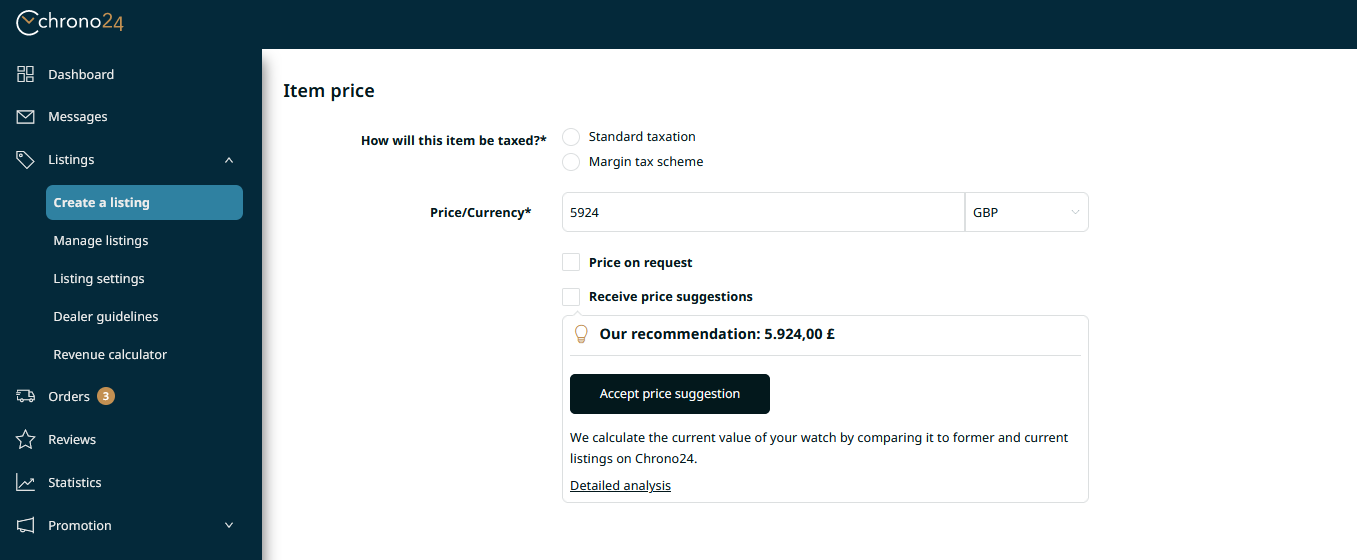

Price analysis

Discover the new price analysis section in your Marketplace Manager Easily compare your prices with current Chrono24 market prices and use other features to strengthen your competitiveness.

April 29, 2025

Listing Optimization

Increase the visibility of your listings and thereby boost requests! Find out how optimal image quality, detailed product descriptions, and realistic pricing increase your chances of selling, why some listings do not receive any inquiries, and how you can change this.